In this section

Deducting an amount for use of a vehicle in line with CRA requirements

Note: the deduction-for-use calculation method in this annex is not obligatory; only the courts can give an authoritative interpretation of the law.

If a vehicle is rejected by a consumer after one or more failed repairs or replacements, you may be able to make a 'deduction for use' from the refund. This deduction should reflect the usage the consumer has had of the vehicle and so a consumer who has had 5,000 miles' use from the car can expect a larger deduction than another who has only driven it for 500 miles. Reductions to refunds can only be applied if the buyer rejects the car after the 'short-term right to reject' period has ended.

The law does not prescribe how to calculate the deduction, but it must reflect the value of the use that the consumer has had of the vehicle, so that in effect the consumer is paying a charge for that use. You can consider all relevant information (for example, the type of goods, the intended use, expected lifespan, etc) when assessing how much use the consumer has had and what level of deduction would be appropriate to reflect this. With cars, mileage travelled is likely to be a key factor.

It is important to recognise that a deduction for use assessment should only consider actual usage of the vehicle and not simply imposing a current part-exchange valuation. It would not be appropriate to simply consult a professional vehicle valuation tool and refund the current part-exchange figure. Such tools reflect a range of factors including live market conditions, depreciation statistics and future retail margins, which are unlikely to be relevant when calculating an appropriate sum for the partial use a consumer has had of a rejected vehicle.

The Consumer Rights Act 2015 (CRA) does not create a method on how to calculate a deduction for use, so sellers must come to an agreed figure using a fair and justified approach. As regulators, Trading Standards services might also be asked to assess the fairness of deduction-for-use calculations.

Given the potential lack of certainty over how to calculate fair and appropriate deductions for use, the Chartered Trading Standards Institute has generated the following calculation approach, which may provide a useful point of reference when evaluating the appropriateness of deduction-for-use calculations. The approach can be used by businesses and regulators to judge whether a deduction-for-use figure is appropriate and fair.

The method laid out in this guide is suggested as one approach that uses the various key factors involved in calculating an appropriate deduction-for-use figure.

Car dealers or their trade bodies may be able to formulate a different system that is a valid mechanism for calculating fair and lawful deductions for use.

Starting point

A key assumption in this suggested method is that the total value of use that a vehicle provides across its entire lifespan could not exceed the original new price of the car. Therefore, if a car cost £25,000 new, the maximum total use that vehicle could provide over its entire lifespan is £25,000.

Next, the value of use derived from a premium vehicle will be higher than a basic car and similarly over time, due to wear and tear, cars will have decreased usability. For that reason, a calculation of use value may factor in the quality of vehicle and reflect declining usability over time.

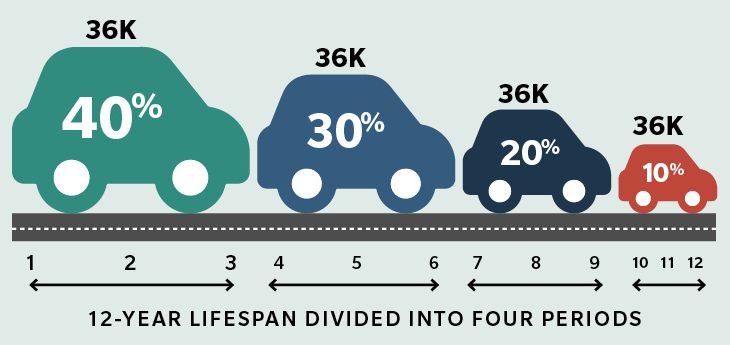

The method further assumes that a vehicle has a 12-year life span, divided into four equal periods. To reflect the decreasing value of use due to wear and tear over time, the method proposes that 40% of the value of use is associated with the first three years, 30% with the next three years, then 20% with years seven to nine, and 10% with the final three years.

The method next assumes that, on average, cars travel around 12,000 miles a year. This means that over 12 years a vehicle would travel 144,000 miles, or 36,000 miles in each three-year period.

Key assumptions

In summary, this method makes four key assumptions:

- the total value of a vehicle's use across its lifetime amounts to the original new price of a car (a figure available to the motor vehicle retail sector)

- an average vehicle has a lifetime of 12 years

- a vehicle travels on average 12,000 miles per year

- 40% of the value of use is associated with the first three years, 30% with the next three years, then 20% with years seven to nine, and 10% with the final three years

The following graph shows the percentage distribution-of-use value across the lifetime of a vehicle and 36,000 portion of total mileage across four age periods:

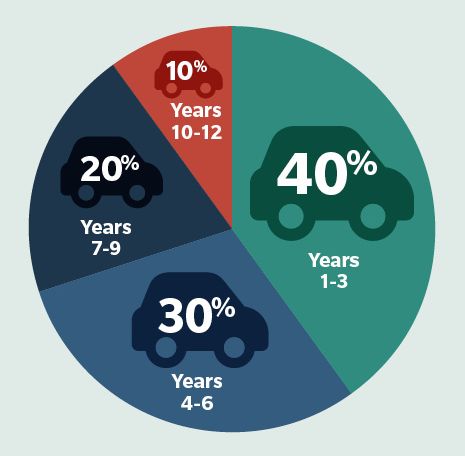

The following pie chart shows lifetime value.

Calculation basics

Pulling the key assumptions together, the method proposes that the average or nominal use per mile for a vehicle before any age-weighting factor would be:

- use per mile = new car price⁄144,000

After adopting the relevant age weightings*, the calculations for each of the 36,000-mile periods are:

- use (period 1) = 0.4 x (£ new car price⁄36,000)

- use (period 2) = 0.3 x (£ new car price⁄36,000)

- use (period 3) = 0.2 x (£ new car price⁄36,000)

- use (period 4) = 0.1 x (£ new car price⁄36,000)

[*The applicable weighting is based on the age of the vehicle at the time of sale, not when it was rejected.]

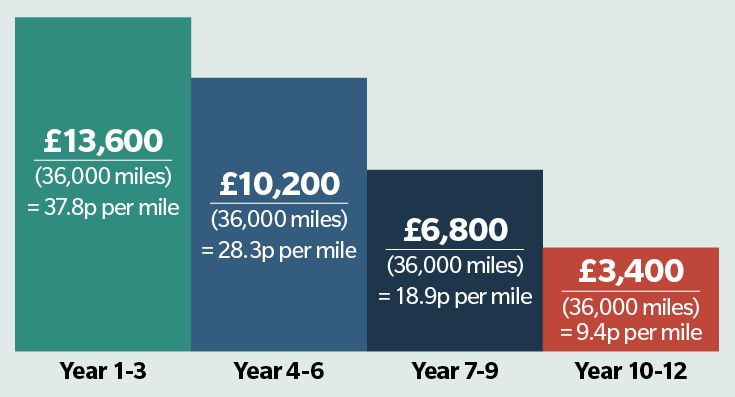

The graph below shows an example; with the new price of the car being £34,000, it shows how the total value of use is distributed across the four age bands:

- £13,600 + £10,200 + £ 6,800 + £ 3,400 = £34,000

Assuming a 12-year and 12,000 miles per annum lifespan, a nominal use per mile rate can be calculated for each age band, as shown in the graph below.

Example calculations

Example 1

A car that is two and a half years old when sold (period 1 weighting factor is 0.4), and according to trade data had an original new list price of £27,450, would have a use mileage rate of:

- use (period 1) = 0.4 x (£27,450⁄36,000) = £0.305 (or 30.5p per mile)

The table below shows the mileage use rate for the four periods, based on the car costing £27,450 when new.

| Period | Mileage use rate |

|---|---|

| Period 1 (years one to three - the example above) | 30.5p |

| Period 2 (years four to six) | 23p |

| Period 3 (years seven to nine) | 15.2p |

| Period 4 (years 10 to 12) | 7.6p |

Therefore, if this example car was sold for £17,500 when two and a half years old, and the consumer drove 1,200 miles before finally rejecting the faulty vehicle, the calculated deduction for use would be:

- 1,200 x £0.305 = £366

This gives a final refund of:

- £17,500 - £366 = £17,134

Example 2

A car that is five years old when sold (period 2 weighting factor is 0.3), and according to trade data had an original new list price of £22,200, would have a use mileage rate of:

- use (period 2) = 0.3 x (£22,200⁄36,000) = £0.185 (or 18.5p per mile)

The table below shows the mileage use rate for the four periods, based on the car costing £22,200 when new.

| Period | Mileage use rate |

|---|---|

| Period 1 (years one to three) | 24.7p |

| Period 2 (years four to six - the example above) | 18.5p |

| Period 3 (years seven to nine) | 12.3p |

| Period 4 (years 10 to 12) | 6.2p |

Therefore, if this example car was sold for £10,500 at five years old, and the consumer drove 1,600 miles before finally rejecting the faulty vehicle, the calculated deduction for use would be:

- 1,600 x £0.185 = £296

This gives a final refund of:

- £10,500 - £296 = £10,204

Example 3

A car that is eight years old when sold (period 3 weighting factor is 0.2), and according to trade data had an original new list price of £15,300, would have a use mileage rate of:

- use (period 3) = 0.2 x (£15,300⁄36,000) = £0.085 (or 8.5p per mile)

The table below shows the mileage use rate for the four periods, based on the car costing £15,300 when new.

| Period | Mileage use rate |

|---|---|

| Period 1 (years one to three) | 17p |

| Period 2 (years four to six) | 12.8p |

| Period 3 (years seven to nine - the example above) | 8.5p |

| Period 4 (years 10 to 12) | 4.2p |

Therefore, if this example car was sold for £4,500 at eight years old, and the consumer drove 470 miles before finally rejecting the faulty vehicle, the calculated deduction for use would be:

- 470 x £0.085 = £39.95

This gives a final refund of:

- £4,500 - £39.95 = £4,460.05

Example 4

A car that is 10 years old when sold (period 4 weighting factor is 0.1), and according to trade data had an original new list price of £37,800, would have a use mileage rate of:

- use (period 4) = 0.1 x (£37,800⁄36,000) = £0.105 (or 10.5p per mile)

The table below shows the mileage use rate for the four periods, based on the car costing £37,800 when new.

| Period | Mileage use rate |

|---|---|

| Period 1 (years one to three) | 42p |

| Period 2 (years four to six) | 31.5p |

| Period 3 (years seven to nine) | 21p |

| Period 4 (years 10 to 12 - the example above) | 10.5p |

Therefore, if this example car was sold for £7,000 at ten years old, and the consumer drove 1,300 miles before finally rejecting the faulty vehicle, the calculated deduction for use would be:

- 1,300 x £0.105 = £136.50

This gives a final refund of:

- £7,000 - £136.50 = £6,863.50

> Annex D. Practical checklist

Back to top